'25 Q2 review

19.2% outperformance and my positioning.

I apologise for the late release of the quarterly results. I was busy actively researching an asymmetric bet about which I will soon release a write-up. You can find more info on that at the bottom of this post.

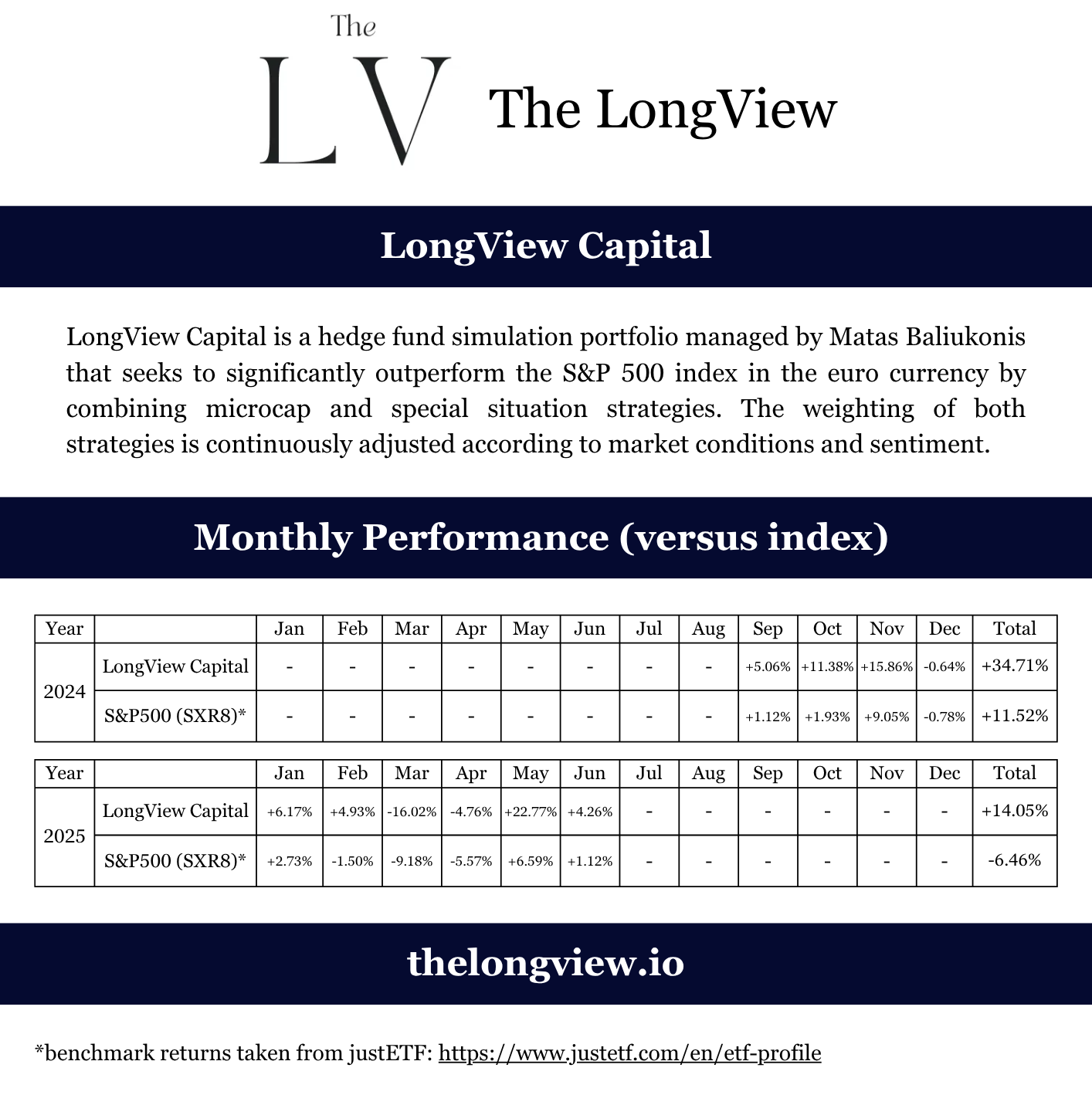

Performance

During the second quarter of the year, the LongView Capital portfolio appreciated by 21.9% versus 1.78% for S&P 500 EUR.

Since its inception, the portfolio has returned 53.64%, compared to a 4.32% return by the S&P 500 EUR.

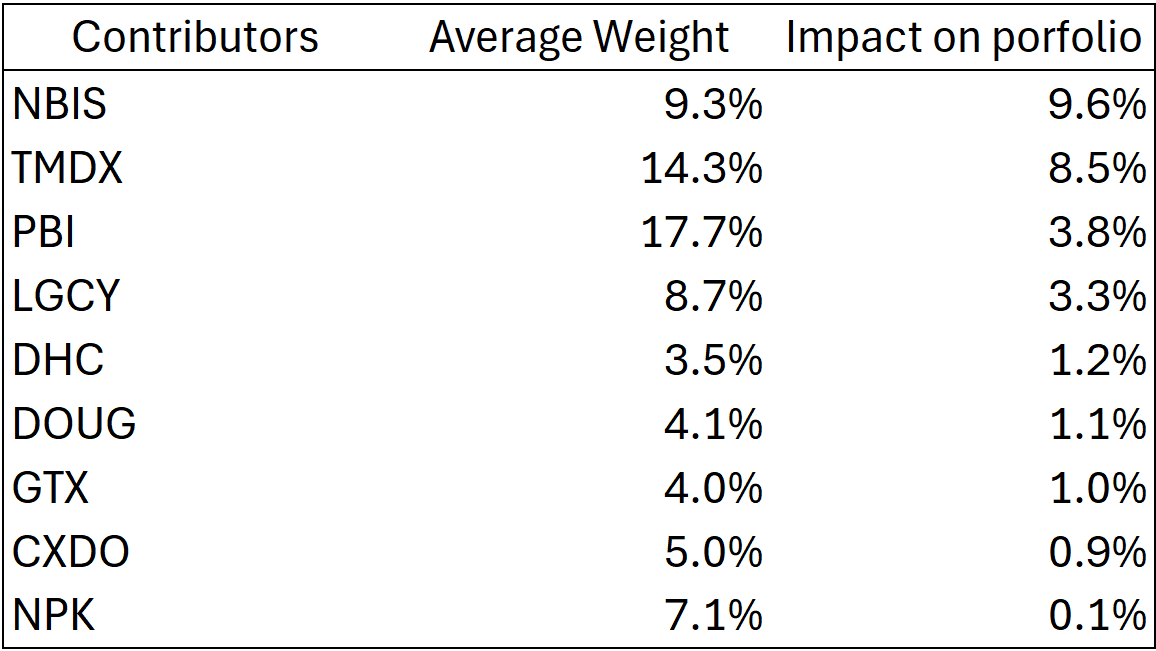

Contributors

In Q2, the market had a risk-on approach, and thus Nebius Group was the best performer in the period (over 130% return).

The quarter reflected the portfolio’s strategy perfectly. We took an educated bet during Q1 on Nebius, seeing a beaten-down company that could rebound rapidly if the tariffs were delayed (or cancelled), and it played out as intended. Throughout the quarter, we continuously adjusted our position to counter the market and reduce risk as it reached new highs. At the time of the letter release, we closed out the position at an approximate gain of 150%.

Another notable company was TransMedics, whose stock’s movement, rather than its financial performance, exceeded my expectations. I had expected the market to have factored the flights’ outperformance into its valuation (see Q1 report). As expected, the company crushed its Q1 earnings. You can find a live flight tracker here. While there was some seasonal weakness in July, we saw their founder buy $2 million worth of stock and the beginning of the flights ramp up.

Other quick mentions:

Legacy Education did well on its earnings, which I wrote up. The total return for my paid subscribers now stands at 52.3% since my write-up in February. Find both write-ups below.

Pitney Bowes continues to exceed expectations. During Q2, Kurt Wolf assumed the role of CEO and outlined some near-future actions concerning increased share repurchases, faster-than-expected deleveraging and, most importantly, a strategic review of the company. Besides basic optimisations, I believe Mr. Wolf could be playing for a sale, which would likely occur at stock prices >100% higher. Nevertheless, I am happy to hold in any case and believe that the stock is significantly undervalued (Berkshire Hathaway director Meryl Witmer agrees, having just pitched the company to Barron’s, which led the stock to rise 13% in a single day). Furthermore, after reporting Q2 earnings, the company’s stock has been performing rather poorly. While there were negative aspects about the quarter (Presort issues due to the (now) previous management prioritising high margins vs total growth), the company raised the 2025 EPS forecast due to buybacks. After the quarter was released, Mr. Wolf initiated a non-dilutive convertible offering (if you want the financial engineering explanation, DM me) to buy back shares even faster. The company and its CEO are fully aligned to provide great long-term shareholder returns, and so I am happy to continue holding my position.

Douglas Elliman was wrapped in rumours about a $4/share takeover, which caused the stock price to increase. As nothing materialised, the stock has since trended down. Nevertheless, I believe in the long-term prospects of the company and continue to hold.

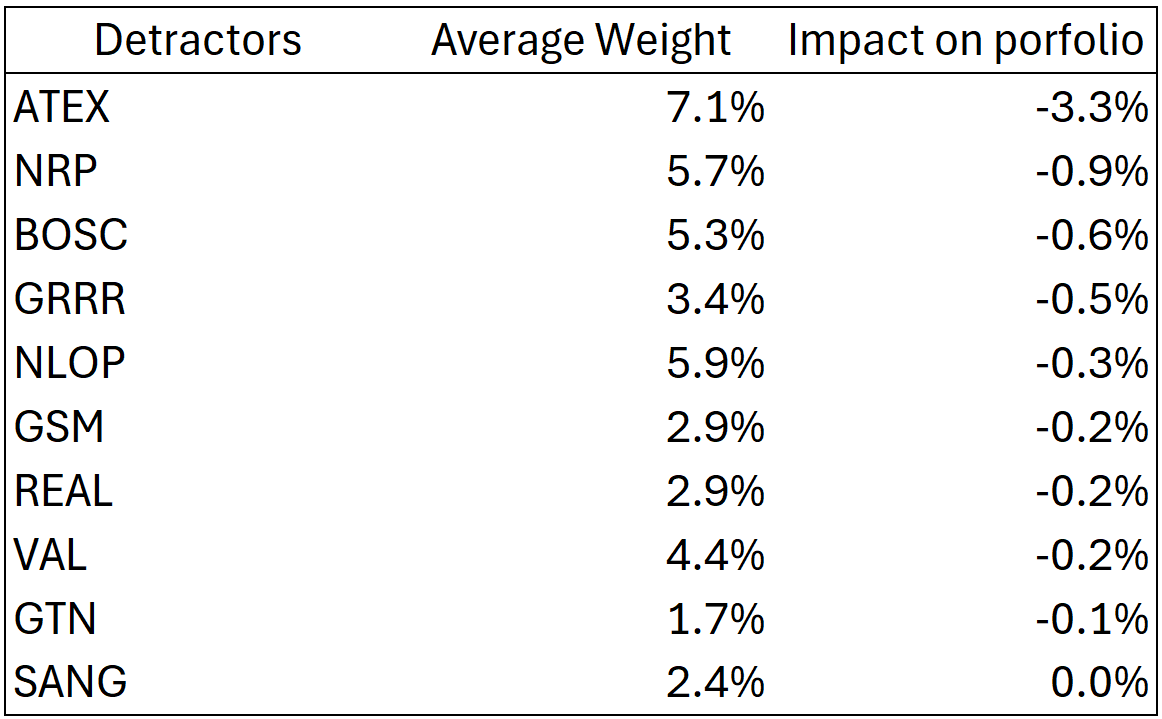

Detractors

The only thing to note here is that I followed Nat Stewart in selling ATEX. The stock price continued to stagnate, and it appears that the possibility of a takeover at a significantly higher price has diminished. I prefer to take my money and move to higher-IRR and higher-conviction plays.

I also exited some other companies, about which paid subscribers were alerted live.

Positioning for Q3/Q4

One thing microcap investors often forget: in downturns, liquidity in the riskiest names can drop to near zero. Who’s stepping in to buy a stock that’s down 90% while they’re worrying about their mortgage? This market can make high-risk/high-reward names look far more liquid than they’ll be when conditions normalise. Keep that in mind.

Now, however, I still think that the current bull run has some legs. During my initial drafts of this quarterly letter, I wrote extensively about uncertainty and the market's lack of awareness of it. Now that tariff deals have finally begun to be made, it seems that the market was right, and I was wrong to be as cautious as I was. I sold NBIS and increased my TMDX and PBI positions as I was the most bullish on them (and still am).

We are now up approximately 20% YTD at the time of the letter release, and I need to find more great opportunities to deploy some of the cash position we have built.

I will soon be releasing a write-up on an asymmetric play with regulatory (no, not telecom) tailwinds on a company with disappointing IR and many past delays, which led to a sharp decrease in stock price. However, one particular event makes it so no more delays are possible, which my discussions with the CEO confirmed.

Write-ups

Current returns of YTD stock write-ups/mentions:

Write-ups:

LGCY (FEB): 52%

Fallen 70% gross margin turnaround (MAY): 1%

Nanocap special situation (JUN): 54%

Average: 36% (not good enough with such volatile stocks, but acceptable as a short-term result).

Annual picks: +24% (will do a separate post on the holdings and their performance).

Research report (JUN 27):

ALOT: 23% +

My report comment: “I am putting this one on the watchlist and will dive deeper if Mr. Patel wins the proxy fight on July 9th.”

ARQ: 33% +

My report comment: “Putting the company on my 'high-priority‘ research watchlist and consulting experts to see how likely the company is to launch the plant as now guided.“

MYO: -49% +

My report comment: “Despite these developments, I remain sceptical that the company can materially improve bottom-line margins or scale sufficiently to justify its current risk profile—especially given a year-over-year decline in backlog.“

All content is provided for informational and educational purposes only and does not constitute investment advice. You are fully responsible for any decisions made after reading my materials. My analysis, which may contain errors, is based on public information such as SEC filings, press releases, interviews, and current events. Past performance does not guarantee future results.

My affiliates or I may hold positions in the securities discussed at the time of publication, and we are under no obligation to maintain them. Neither I nor my affiliates accept any liability for any direct or indirect loss arising from the use of this information. Nothing herein is an offer or solicitation to buy or sell any security.