Recently IPO'd Microcap with Multiple Catalysts in 2025 and 2-3x Upside

Hard to model microcap due for an earnings boost from recent and upcoming acquisitions.

Some quick info: These more detailed, higher-return potential plays will be under a pay lock but will become free to read once they hit a 40% gain. Quarterly portfolio reviews and occasional writeups will be accessible to all subscribers.

Today’s pitch is quite simple. A recently IPO’d ~$90M micro-cap company finalized a highly accretive acquisition at the end of last quarter for around 5.25x P/E that will significantly improve its earnings profile starting with subsequent earnings. Additionally, the company is profitable and now has 16.9 million in cash, likely to be used at least partly for other acquisitions, which I suspect could be announced as soon as 2025. I see a 150-300% upside over the next 28 months.

As some may have guessed, I am talking about Legacy Education, one of my four 2025 picks (the others are $GRRR, $TMDX, and $HASH).

Share price: $7.60

Market cap: $94M

LTM revenue: $52.72M

LTM income: $6.3M

Debt: $1.09M

Cash and equivalents: $16.87M

Average daily volume: 96,250

Shares held by insiders: 32.17%

Legacy Education doesn’t provide any concrete guidance or projections. It has been floating around Fintwit for a few months but has yet to reach any level of excitement. I believe this to be an excellent opportunity to buy a company that trades at ~15 P/E while growing its revenue and profits by 30% annually, with more growth ahead.

Business Model

Legacy Education delivers concise, career-focused educational programs, primarily targeting the healthcare sector. The company offers 47 certificate and degree programs in fields such as nursing, medical technology, dental assisting, and business administration. The company does a great job by attaching itself to fast-growing industries projected to compound at an annual growth rate (CAGR) of 16% through 2030.

Operating four colleges across six campuses in California, Legacy Education generates approximately 92% of its revenue from tuition and laboratory fees. The remainder is derived from books, registration, and miscellaneous charges.

Analyst models typically emphasize organic growth, yet few account for the financial benefits stemming from the ongoing acquisition of smaller institutions and the resultant synergies. I estimate that the recent acquisition of Contra Costa Medical Career College (CCMCC), along with potential future transactions, is undervalued in current projections.

Management & History

LeeAnn Rohmann founded Legacy Education in 2009 and continues to serve as the CEO and Chairman up to this day. She owns 7.2% of the company. That, to my knowledge, comprises the majority of her net worth.

For years, the company has operated with little leverage, acquiring four small colleges one by one and implementing them into its system.

High-demand programs and relevant solutions will continue to drive small to medium long-term growth

All of Legacy Education’s programs are created/developed to solve these problems:

Low ROI on the high tuition for most colleges → Legacy Education provides high ROI on their degrees by providing affordable education in high-demand and high-paying jobs;

High risk of not getting a job placement straight out of university → all of the degrees LGCY offers are for high-demand jobs with a low supply of potential employees (see the visual below);

Most of the time spent on studying is wasted on non-relevant information to a specific occupation and thus takes quite long (7+ years) → Legacy Education offers short (sometimes less than a year) education that is specialized to a specific vocation;

By solving relevant problems, Legacy Education organically attracts more and more students to the same colleges per year. This is proven by the building of multiple campuses for the same colleges to meet the influx of additional students and still not having enough space.

This quarter, Contra Costa Medical Career College (CCMCC) acquisition will drive further financial growth.

At the end of last quarter, the CCMCC acquisition was finally closed, adding around 500 students (now around 3000). It additionally added 14 programs to the company's portfolio (not much overlap).

After some calculations, I estimate that CCMCC will add at least $7.6-8M in revenue and $1.44M in income to $LGCY’s financials in the 2025 calendar year. This is significant as the company's current LTM income is around $6.3M. This would also mean the acquisition was made at around 0.95-1.04x fw P/S and 5.6x fw P/E, as the total purchase price was $8M ($7M of it — cash). This doesn’t even include any synergies that will be made during the next couple of quarters.

Significant cash position with a robust potential acquisitions pipeline.

A big part of my thesis revolves around the management continuing to have accretive acquisitions. There are a couple of reasons why I believe this to be likely:

The management has discussed this repeatedly with optimism:

From the 2025 Q1 call (fiscal year starts in June):

Q: I mean do you have the staff and the people to do another acquisition right away after Contra Costa? Do you have to wait 3 to 6 months?

A: I believe with our current staff, we're poised to be able to support a short-term future acquisition, but we want to make sure that it would be good for both the business and really the future of the company to be able to support it.

Q: <…> talk about M&A a bit as far as what the landscape looks like out there and hopefully, what you're able to achieve over the coming quarters?

A: Well, we definitely believe that just the sector switch and the change, there's a lot of opportunity that is before us, both inside our current California footprint and outside of that footprint. We have been in some initial and early discussions in both of those areas within California and outside of California.

So we believe that there's going to be a significant opportunity for us to be able to capitalize off of that. I want to make sure that we really execute well on the current acquisition that we have upcoming and getting that just executed well as we continue to seek the additional opportunities that may be available to us.

From the 2025 Q2 call:

Q: Could you talk a little bit about M&A, <..> about their pricing, kind of the mental state of some of the buyers and sellers <...>?

A: Absolutely. The M&A continues to be a strong pipeline as you look to see a lot of the single-owner institutions, mom-and-pops that have been in the business for quite some time. There are many schools out there that are quality institutions, they're accretive, and they are looking for opportunities in order for them to get out. So, our pipeline continues to build. And we are really just assessing in terms of our strategic strategies to want to move outside of California and into the right programs that are critical in need and that we believe that our model can easily roll right into.

Q: With the new administration in November, did you see a change in the pipeline?

A: We actually have seen a change in terms of — I think that some people that were sitting on the fence with regard to their decision to stay in or to get out is that they see it as more of an opportunistic time that they can get out. And we have built — we've increased our pipeline since that time.

Legacy Education has over $16.8M in cash and very little debt. I believe its free cash flow should completely cover most ongoing liabilities. Moreover, it’s not worth it for them to invest in inside operations when there are multiple times higher ROI opportunities very close by. I don’t think that with LGCY's M&A experience and returns (assuming they have similar comps across acquisitions), it would seek other options to employ that cash.

Nevertheless, let’s assume that after paying down some debt and current liabilities, we will be left with around $10M for acquisitions. Assuming they can complete one more acquisition in the current calendar year at comparable comps to the CCMCC one (IMO, definitely probable), this would lead to an additional $1.81M in net income.

Combining current and potential acquisitions, the inorganic growth alone would be around 35-40% for the next 12 months. This doesn’t include synergies and relatively high short-term organic growth.

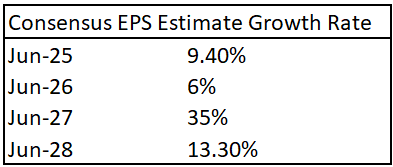

Analyst income projections for the current year are around 10% (see below for a longer-period picture). The analysts' models likely mainly involve organic growth, so investors should get a “free lunch“ in the next quarter or two.

Risks

They operate in an unpopular industry. The scalability of colleges is quite limited, even though a lot of Legacy Education’s learning happens online, and they can also build additional campuses for the same college.

The classes are still primarily in-person, and there is a cap on revenue & expenses per student. That means that most of Legacy’s growth will have to happen inorganically. I suspect this investment will deliver excellent returns with the re-rate in the next 24 months and then start slowing down due to the business's acquisition-driven nature. However, I could be wrong if they continue exponentially finding amazing gems at cheap valuations.

From the December IR presentation (prior to CCMCC acquisition):

~26% of current enrollment is due to successful M&A activities ( While not a significant number at the moment, I expect this to rise rapidly)

90/10 rule. If an institution gets more than 90% of its revenue from federal student aid (Title IV, e.g., Pell Grants and federal loans), it risks breaching the 90/10 rule.

The CFO has said, “I don’t lose sleep over 90/10,” and rightly so. Institutions like LGCY usually have entire teams that model their revenue sources and ensure the rule is not breached. As you will see in the table below, there have been instances where the limit was almost reached, but there are financial measures in place to never exceed the limit. If you want more info on them — message me directly. Nevertheless, if federal aid revenue went over 90% for two consecutive years (improbable), it would lose all aid revenue for the next two years.

California wildfires. One (relatively small) of Legacy Education’s campuses was three blocks away from the final containment of the Los Angeles fire. As it currently has only six campuses (all in California), losing one would lead to a temporary revenue loss. I think online classes, insurance, and other campuses would minimize that loss, but the market could still react strongly (on the fire closing in the news, the stock dropped 15%).

Valuation & target price

If you trust my projections, you will probably agree that 15x P/E is quite forgiving for a business growing this fast. I’m not saying this is the next Constellation Software, but you would be buying a company with a significant pipeline of businesses to buy for 5-6x P/E (prior to any synergies, of which there are plenty).

Below are my napkin math projections for potential IRRs in different scenarios. You can try to do the inputs yourself, but I get a weighted 39% annual return for the next 3 years (2.73x). With some fintwit love, I think it can get to that much quicker, but I like to stay optimistically conservative.

Final thoughts

$LGCY seems to be consolidating after a 95% runup in the past 6 months since its IPO. If you decide to build a position, I recommend buying 50% now and then 50% before earnings to maximize your potential IRR.

Legacy Education is my second-largest position at 9% of my portfolio.

Disclaimer:

All content is provided for informational and educational purposes only and does not constitute investment advice. You are fully responsible for any decisions made after reading my materials. My analysis, which may contain errors, is based on public information such as SEC filings, press releases, interviews, and current events. Past performance does not guarantee future results.

My affiliates or I may hold positions in the securities discussed at the time of publication, and we are under no obligation to maintain them. Neither I nor my affiliates accept any liability for any direct or indirect loss arising from the use of this information. Nothing herein is an offer or solicitation to buy or sell any security.