The Alchemy of Portfolio Construction

How to build a portfolio that makes sense for YOU?

Portfolio allocation is more art than science. A well-rounded portfolio is not the same for everyone; it must reflect your financial capabilities, goals, and even character. In this essay, I hope to provide some guidelines and mental models of other investors to help you down this road.

Thanks to all 135 subscribers who have joined us since the last post!

Terms to know:

Alpha → excess return (how much more do you make than the index)

Sharpe ratio → how much risk are you taking for x amount of returns?

Let me draw you into a tale from my early days of investing. Picture me at 12 years old, brimming with excitement as I made my first purchase in the stock market. With youthful enthusiasm, I allocated 10% of my modest portfolio to what seemed like a promising opportunity. I could practically taste the success, envisioning all the different types of Ice cream I could buy with the profits.

But then, the inevitable happened. The stock took a tumble, plunging 10% almost as soon as I'd dipped my toes into the market. Undeterred, I doubled down, convinced that this was a temporary setback. Yet, with each subsequent dip, my confidence disappeared, and my allocation size grew until that once-small portion of my portfolio that grew to 40%, was down 50%. Thinking it was about to reverse, I increased the stake to 55%.

Then… it halved again. All of this because I didn’t have a look at my portfolio from a bird’s eye view, and was just thinking of how much cash I would have after the stock returned to “the normal“. Stocks that are down 99% can still fall 99.9%. The thinking that it already fell a lot and should suddenly stop is poised to lose money.

Asset classes

“Should I invest in bonds, crypto, hedge funds, etc.?” is a question I get often asked. I always answer - it depends.

As both an endowment CEO and a retail investor, I care for radically different portfolios with different risk appetites and capabilities. In my opinion, these are the questions you should think about when laying out your portfolio asset class allocation:

Risk-return expectations

When inquiring about investing opportunities, my dad always asks for only one thing “I have to make 8-10% guaranteed every. single. year.“ My answer is always, “Sadly, that’s not how the market works.”

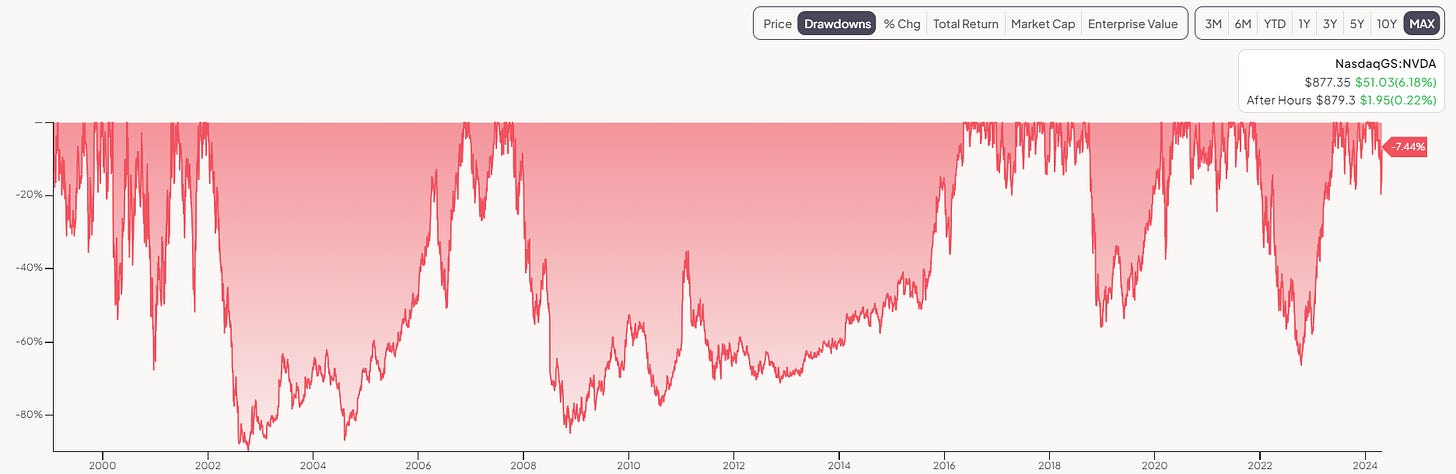

If you want excellent (not decent) returns, you must be ready to go through periods of underperformance and doubt. Take a look at NVDA 0.00%↑ drawdowns over the years:

How would you feel if your best performer fell 85%? Would you be able to sleep at night?

The only way to get (almost) guaranteed money is to buy government bonds with 4-5% yields right now. If that satisfies you, it will be the easiest money you make. If you want 50% annual returns, that will mean investing in crypto + high volatility stocks. This also means that you can lose the entirety of your investment.

Portfolio size

This is pretty simple: if your portfolio is relatively small, you should not be trying to diversify it into every single asset class. You should 1) get your savings rate up and 2) allocate more to higher-risk assets. The only way diversifying $1000 in all asset classes makes sense is if you are trying to learn. If that is the case - diversify away.

I also like to compare my portfolio size with my monthly salary. If my risky investments caused my portfolio to fall 50%, how many months of my salary would I need to put back into it to compensate for the losses?

Now, if we are talking about $1’000’000 - $5’000’000 sized portfolios that provide for you and your family, more work has to be done to significantly reduce public market risk, volatility, and, unfortunately - some returns. It doesn’t mean not investing in riskier assets but controlling their weighting. In the end, it is not worth risking your family’s quality of life for 1-2% alpha.

You should also remember that many asset classes have monetary barriers to entry, sometimes exceeding millions: hedge funds, PE funds, VC funds, etc. These are the elite tools for portfolio management as they allow for more uncorrelated returns and sometimes - alpha.

One thing that is difficult to grasp when managing an endowment portfolio is that we are not looking for the best return opportunities. Students and the faculty rely on us to get scholarships, and they don’t care that the S&P500 dropped 5% that year. This means we can’t invest everything into growth stocks or even compounders that, in the long run, would perform best.

Liquidity/time horizon

Most people think that they don’t care about liquidity, given that the returns are fine. Now let me give you an example from experience. In 2021, the Baltics region experienced 20%+ inflation, during which we started buying up private funds that bought forests. The strategy worked, and in 2022, we generated more than 30% returns in less than 6 months.

Next, inflation started normalizing, and the fund returned only 8% in 2023, thus underperforming the broad market. In Q1 of 2024, it returned 0.2%. My point is that everyone is OK with illiquidity as long as you see numbers go up. What about if they start going down every single quarter, and you can’t do anything?

Another point is that if you put all of your assets into illiquid funds, what happens if you need some cash to buy a house or get fired? You need to plan for this. For big portfolios, I suggest keeping around 8% cash for your living needs, 40-50% in less liquid assets, and 40%+ in equities. This will allow for the most flexibility.

Making the decision

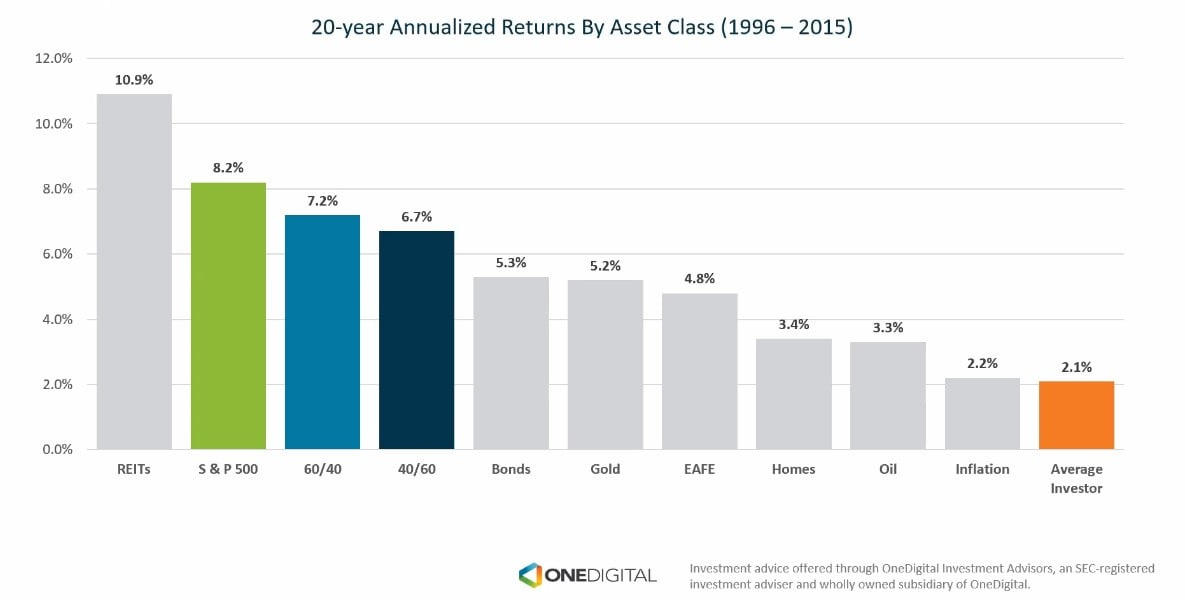

In reality, most retail investors should just stick to investing in equities unless they have a portfolio responsible for covering their daily expenses.

Every single asset class requires specific knowledge to operate successfully, and you could only be shooting yourself in the foot by trying to cover all classes.

What I would recommend to people with bigger portfolios is just finding the right managers who specialize in specific asset classes that you would like to cover and allocating your money to them.

Concentration

We have all heard the saying, “Diversification is protection against ignorance“. It is almost true.

There are two main things in allocation concentration:

Time and skill

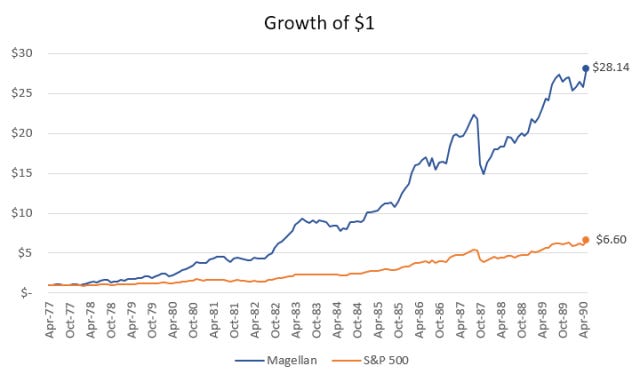

Did you know that the legendary investor Peter Lynch, who returned more than 29% CAGR in his 13-year tenure, held more than 1’000 stocks at almost any time?

He had both the time to fully commit to research AND the skill to pick the best stocks possible.

No average retail investor could invest in a thousand different companies and still outperform the index by skill and not luck. Would you read through a thousand quarterly reports every three months? I definitely wouldn’t…

Return expectations

There is straightforward logic in diversification. The more companies you own, the more your performance will trail the index. François Rochon has returned over 14.5% CAGR so far in his 30-year tenure at Giverny Capital. In 2006, he underperformed the market by 15% (3.5% vs 17%). To outperform in the long term, you have to be willing to underperform in the short term.

When trying to understand what specific weighting you want to give a particular company in your portfolio, think about the following:

Expected returns (what is good for your investing style? How does it fit in your portfolio?)

Risk/reward (think overvalued stocks)

Stability (will you manage the volatility?)

How long will you hold the position (some stocks may take 5+ years to return to their intrinsic value after a big drop; will you be able to hold a sizable position in a company like this?)

For example, I hold only 9 positions in my portfolio, with my top 3 being 67% of my portfolio. This means I sometimes underperform and sometimes destroy the market. I am completely fine with that until my long-term returns are higher than the indices, and I definitely don’t care about my personal sharpe.

On the other hand, Rochon suggests holding 20 different companies with around a 5% weighting to diversify enough so one company can’t kill you but also not too much so individual companies can noticeably impact the performance.

Now, if we talk about the VJHS endowment, we have 29 positions, 7 of them being broad-market ETFs (total exposure to 1500+ companies). That is a radically different strategy that, as I mentioned, will provide for the school almost every single year. For example, in 2022, we returned 0.12%, and in 2023 - 8.4%. Not exactly mind-blowing numbers, but that’s not what we are looking for.

You have to decide for yourself what the right strategy is for you and be able to adapt it as you and your preferences change.

N.B.! Humans are emotional beings. If you try to switch your strategy every single year, you won’t succeed! You will sell your -60% growth stocks in a downturn, switch to healthcare and then sell the healthcare for a loss to go into high-tech that is already up 500%+ since you sold. Be very mindful of this.

I hope this was of some use to you and let me know if I should continue writing essays like this :) See you soon in my Lumine deep-dive!

> with my top 3 being 67%

What stocks?