Research report #1

Free early-stage due diligence report on $ALOT, $ARQ, $MYO

AstroNova (ALOT) → MC: $68.8M┃EV: $111M ┃P: 9.1$

The Rhode Island-based printing technology manufacturer operates through two primary segments: Product Identification (PI) and Test & Measurement (T&M), serving aerospace, defense, and industrial printing markets (for example, making label printers).

The company showed up on my screeners as a potential turnaround play. They have implemented a cost-reduction program (goal: $3m/year). Additionally, they aim to boost inventory turns, diversify the supply chain, replace legacy printers with modern ones, simplify the supply chain, and cut costs. However, in addition to the great opportunities that lie in the business, there are many red flags with the company’s management.

First, they have dealt a devastating blow to the company by acquiring MTEX without conducting thorough due diligence. After the transaction, it was discovered that the company was not as successful as initially indicated, which led ALOT to perform a 70% ($13.4M) goodwill impairment and shut down 70% of its operations. It is still losing $1m a quarter, which is significantly impairing the consolidated financials.

Moreover, management has long been discussing the issue of increasing inventory turns, but it has only continued to rise with no real actions taken. That is the reason why I don’t trust that this time the turns will somehow improve without changing the management.

Activist Samir Patel with Askelladen Capital is now leading a proxy fight to turn the business around. After reading his initial presentation and the company’s textbook proxy defence response (find both below), I believe that his proposed action plan and the board make much more sense than the current underperforming management. I highly recommend reading both presentations to gain a comprehensive understanding of the situation.

I am putting this one on the watchlist and will dive deeper if Mr. Patel wins the proxy fight on July 9th.

Resources to get a closer look:

Mr. Patel’s held “townhall“ transcript:

Quick reminder: there are only 2 days left to claim a 30% lifetime discount.

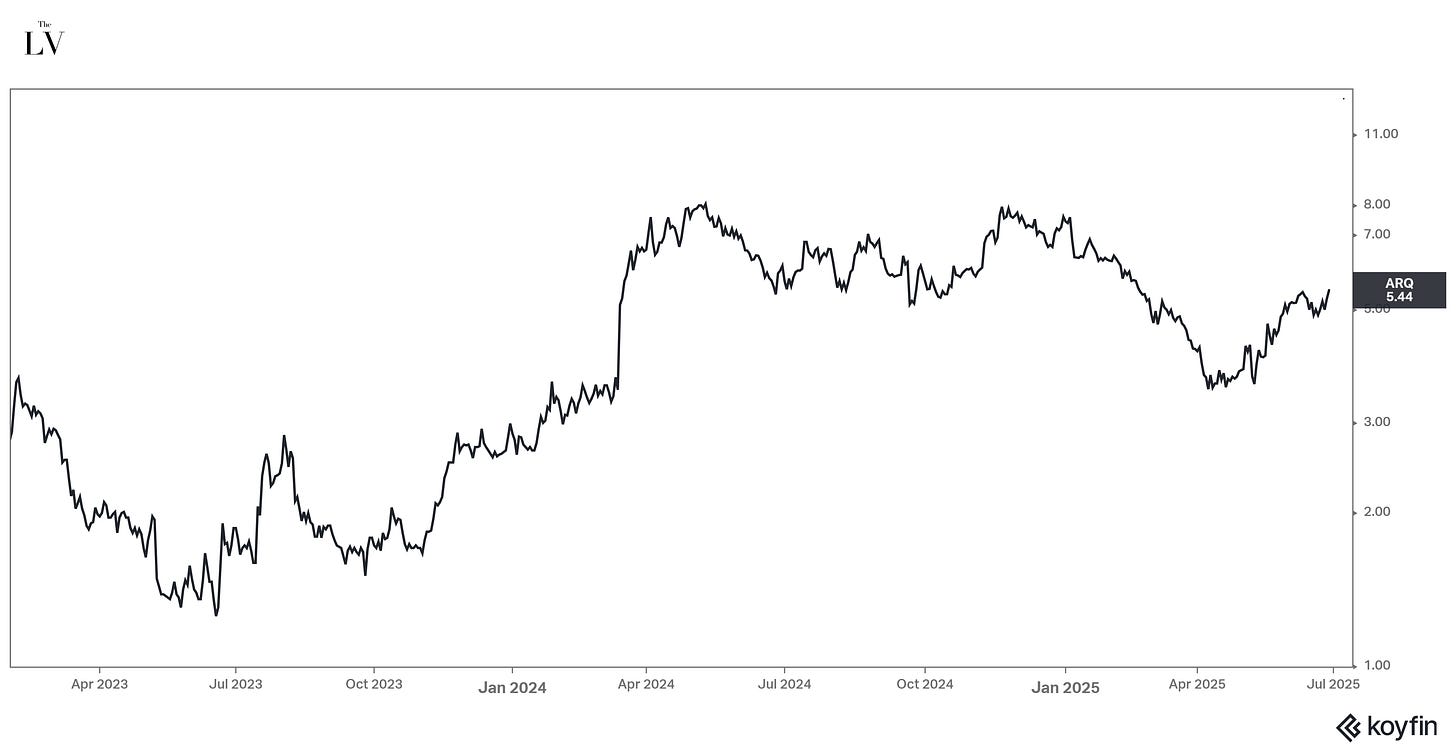

Arq (ARQ) → MC: $210.2M┃EV: $241M┃P: $5.43

Arq is an entirely domestic climate-tech company that manufactures activated-carbon products designed to reduce and, in some cases, reverse environmental damage. While its technology has countless applications, the one that caught my attention is water treatment.

In April 2024, the EPA issued the first legally enforceable standards for PFAS “forever chemicals” in drinking water. That rule is expected to drive a 3x-5x surge in demand for granular activated carbon (GAC) over the coming years. Arq is perfectly positioned to benefit, having built a mechanically finished—but not yet launched—manufacturing plant with a 25-million-pound annual capacity (52% of which is already contracted). However, technical issues in the product-binding and shaping processes have delayed commercial production to Q2–Q3 of 2025.

Although Arq has implemented operational improvements that have slightly boosted profit and revenue, the company has been betting heavily on this new plant. Its cash from operations weakened last quarter (due to investments in the plant), its share count rose by 15% over the past year, and it has invested more than $80 million in CAPEX for construction.

Analysts still forecast nearly a tenfold increase in EBITDA over the next four years, implying a 3.4× EV/EBITDA or 5× P/E ratio at today’s valuation—but those projections leave little margin for further hiccups or dilution.

Ultimately, Arq’s fate looks binary: stock price will likely depend on when the plant comes online and how quickly it ramps up. The underlying demand is undeniable, and a smooth launch could reshape the company’s economics.

Putting the company on my “high-priority“ research watchlist and consulting experts to see how likely the company is to launch the plant as now guided.

Resources to get a closer look:

Interview with Arq CEO transcript (highly recommend reading):

Myomo (MYO) → MC: $79.9M┃EV: $66.6M┃P: $2.2

The United States company designs, develops, and manufactures wearable robotic braces (MyoPro) to assist individuals with weak or paralyzed arms in their daily activities.

On April 1, 2024, CMS began reimbursing MyoPro under Medicare Part B, vastly expanding the addressable market—59% of Q1 2025 revenues now come from Medicare patients.

This reimbursement boost drove 97.6% revenue growth (LTM), wider margins, and improved operational metrics. The company is targeting $100 million in revenue and $15–20 million in EBITDA by 2028, with the potential to reach cash-flow breakeven in 2025.

Despite these developments, I remain skeptical that the company can materially improve bottom-line margins or scale sufficiently to justify its current risk profile—especially given a year-over-year decline in backlog.

Pass for now.

Resources to get a closer look:

Investor day transcript:

Disclaimer:

All content is provided for informational and educational purposes only and does not constitute investment advice. You are fully responsible for any decisions made after reading my materials. My analysis, which may contain errors, is based on public information such as SEC filings, press releases, interviews, and current events. Past performance does not guarantee future results.

My affiliates or I may hold positions in the securities discussed at the time of publication, and we are under no obligation to maintain them. Neither I nor my affiliates accept any liability for any direct or indirect loss arising from the use of this information. Nothing herein is an offer or solicitation to buy or sell any security.