Portfolio and thesis update #2

Revealing new positions, moves, and thesis behind my equity investments.

Hey! Welcome back to another post about my investing strategy. I swear I will continue with the stock writeups as soon as I come back from my holidays :)

The main thing to remember about my strategy is that WINNERS KEEP WINNING… As long as they don’t get complacent…

Let me remind you of my strategy:

Buy wonderful companies that have clear catalysts to rise in the coming years;

Track record and predictability decide the weighing;

I want to be lazy, meaning I always prioritize adding to existing positions over getting new ones if the new stocks do not increase the average company quality of the portfolio.

I treat businesses like they were my family’s business. Would I be comfortable having this company as 100% of my net worth and being unable to sell for at least 20 years? If the answer is yes, I look further.

Let’s dive in my new investments and smaller bets:

5. Dino Polska (10.04%)

Overview

Ticker: DNP.WA

5 Yr. revenue growth: 34.3% CAGR

5 Yr. EPS growth: 35% CAGR

2 Yr fw. revenue growth: 19.3% CAGR

2 Yr. fw. EPS growth: 25.1% CAGR

ROE: 30.6%

ROCE: 28.6%

ROIC: 17.7%

Dino Polska S.A., together with its subsidiaries, operates a chain of mid-sized grocery supermarkets under the Dino name in Poland that focuses on capturing the rural population by winning on proximity, price, and for investors - efficiency.

Like most companies I own, Dino is a fast-growing, efficient, and founder-led company.

Dino's share price has recently weakened due to lowered investor expectations and a decrease in the speed of store count scaling.

Valuation

Trailing P/E: 26.76

Forward P/E: 21.41

Forward P/FCF: 41.35

Thesis for outperformance taken from Fundasy’s Dino recent overview that I think does a much better job than I would have:

I think with the following assumptions, it becomes very easy to underwrite Dino Polska for a good long-term investment at today’s 4% earnings yield:

Conservative topline growth of 17.5%

Net Income margins of 6.50% from today’s 5.48%

A High PE Multiple at a 5% yield (20 PE) from today’s 25.8 PE, contributed by likely either (1) International Expansion or (2) Capital return to shareholders

ForEx: With a conservative annual 1% loss in PLN value, resulting in 90% of total’s exchange value

UNKNOWN: The kicker for returns in the future will be what the company does with the cash on the Balance Sheet. Even without this though, the napkin math returns looks as follows:

[ (1.175^10)*(6.50/5.48)*(20/25.8)*(90%) ] ^ .1 = 1.156 (15.6% Annualized CAGR)

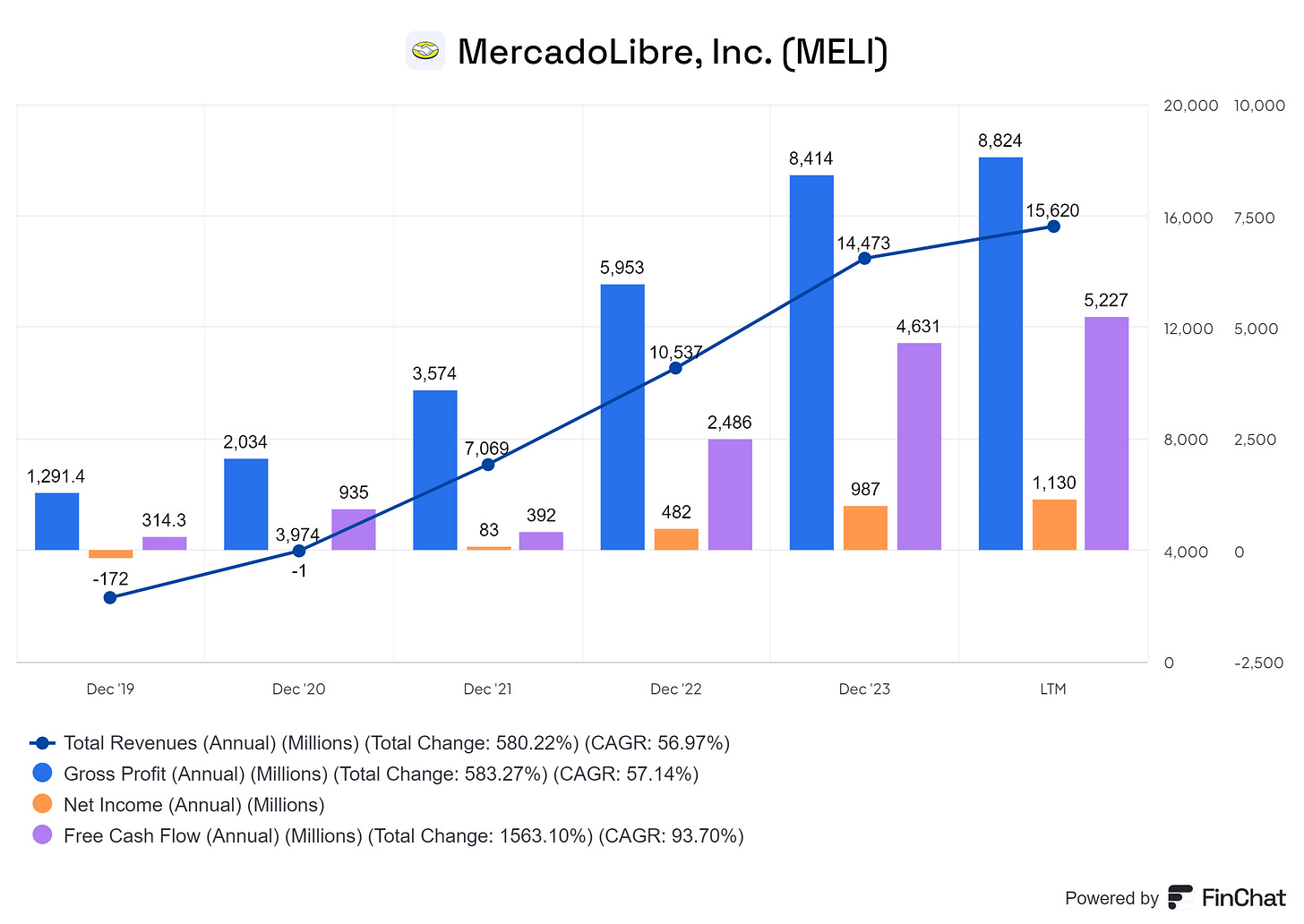

6. Mercado Libre (7.9%)

Overview

Ticker: MELI 0.00%↑

5 Yr. revenue growth: 57.9%

5 Yr. EPS growth: 124.1%

2 Yr fw. revenue growth: 25.7%

2 Yr. fw. EPS growth: 40.5%

ROE: 14.2%

ROCE: 14%

ROIC: 1.7%

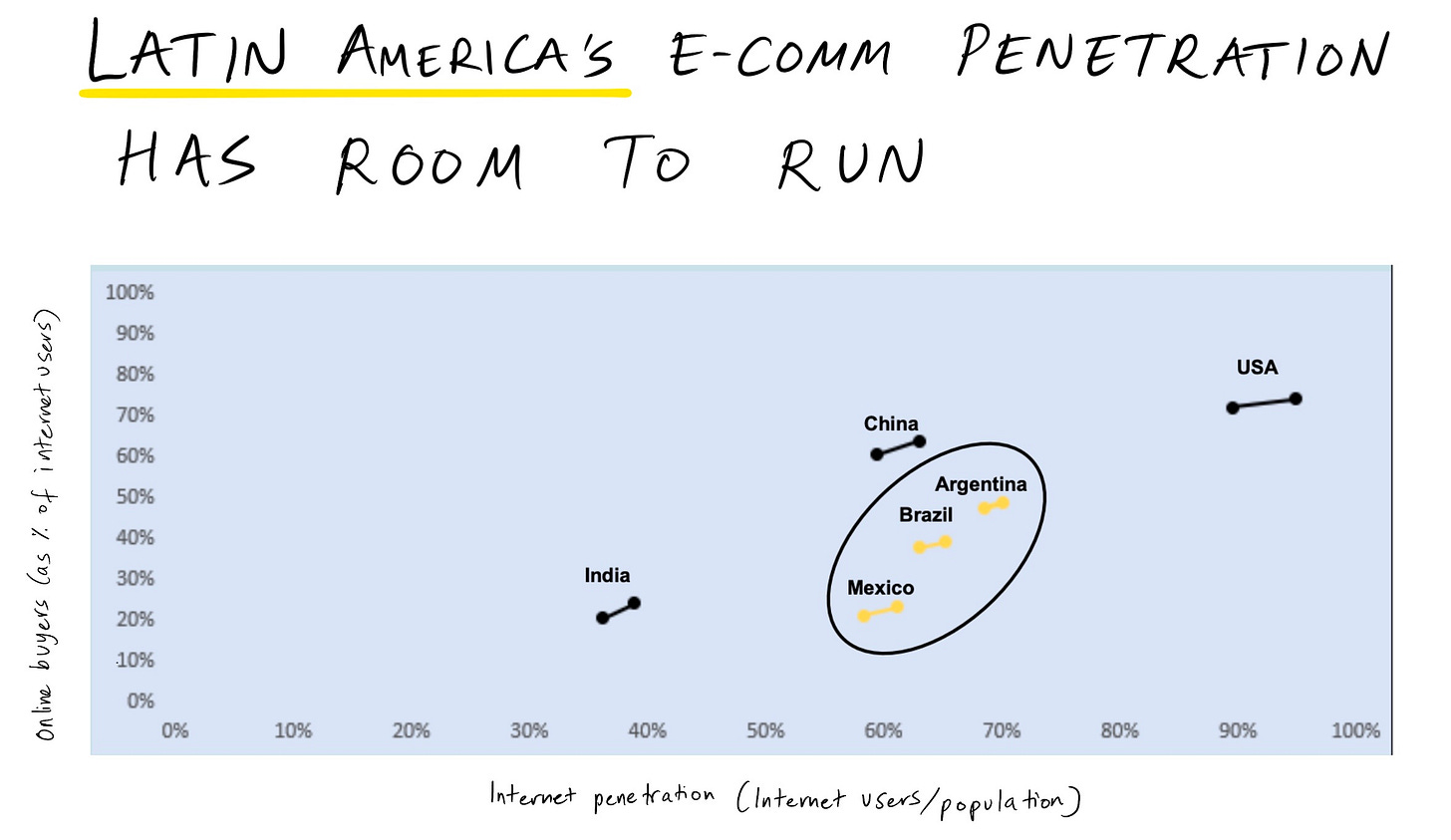

Simply put, Mercado Libre is the Amazon of South America which additionally provides financial, advertisement, logistics, and other services. It is truly an emerging markets behemoth with an $81Bn+ market cap.

Valuation

Trailing P/E: 26.7

Forward P/E: 21.4

Forward P/FCF: 41.1

Thesis for outperformance

A monopoly encompassing many industries that will and is riding the South America growth and will continue to do so even more in the future.

7. Teqnion (4.7%)

Overview

Ticker: TEQ.ST

5 Yr. revenue growth: 34.7%

5 Yr. EPS growth: 19.09%

2 Yr fw. revenue growth (management’s goal): 15%+

2 Yr. fw. EPS growth (management’s goal): 15%+

ROE: 23.35%

ROCE: 17.2%

ROIC: 13%

Teqnion is a Swedish industrial group that operates through independent subsidiaries that it acquires. Through these companies, Teqnion offers leading products in a diverse array of industries. In summary, as the founders say, they are trying to build a mini Berkshire Hathaway.

Teqnion is a company that is overvalued but still very promising. The reason for that is the founders. They are smart, young, and very, very hungry.

To be honest with you, I believe this investment could definitely stagnate at least for some time or be a multi-bagger. I’m willing to bet.

Valuation

Trailing P/E: 30.5

Forward P/E: 25-27

Forward P/FCF: 34-35

Thesis for outperformance

Great management team

High growth with cyclical bets recovering

Very long runway

8. Dream International (3%)

Overview

Ticker: 1126.HK

5 Yr. revenue growth: 9.1%

5 Yr. EPS growth: 20.1%

2 Yr fw. revenue growth: -

2 Yr. fw. EPS growth: 52.3%

ROE: 17.25%

ROCE: 20.5%

ROIC: 18.6%

Dividend: 11.34%

I was genuinely trying to decide whether to include this company I found through DavidOrr on X. It is nowhere close to my strategy of buying long-term winners and holding them for even longer. It’s an Asian company with most of its operations in Vietnam that essentially has factories that manufacture toys.

In essence, if it was not listed in HK and didn’t operate in China, it would have a P/E of 20+ and much more recognition but most investors are staying away purely for the geographical location. Otherwise, the founder has 70%+ insider ownership, and the efficiency, profitability, growth, and dividend are all great signs of the health of the company. I guess it depends on each individual to weigh the risk of China vs the qualities that the company possesses.

Valuation

Trailing P/E: 4.04

Forward P/E: 5

Forward P/FCF: 2.5-3

Thesis for outperformance

It is essentially a hedge fund-type play that manufacturing will continue to leave China and go to countries like Vietnam, and the growth, coupled with multiple expansions, will deliver 40%+ annual returns.

Thank you once again! As always, if you have any feedback, I love receiving tips and opinions to improve my writing! See you soon.